Free help: USER GUIDE

Home > Clients & Profits X User Guide > Accounting > Job Cost Transfers

|

Clients & Profits X Online User Guide |

Costs can be easily transferred between jobs and tasks.

Costs transfers are always added

in pairs: you’ll enter the job and task from

which the cost is being transferred, then the job

and task that will get the transfer. (A cost can’t

be transferred from a job without first entering

another job and task.) Any cost and gross amount

can be transferred, up to the total unbilled cost

amounts on the job task. Otherwise, there’s

no limit to how costs can be transferred:

Costs can be moved from one job to a different job.

Costs can be moved from one client’s job to another client’s job.

Every transfer can move both a cost amount and a gross (or billable) amount. However, you generally should move only the gross amount -- and not the cost amount. Here’s why: the purpose of cost accounting is to see an accurate total of what it cost to produce a job. Whether the job was billed or not doesn’t matter; you spend the same whether it got billed or not. If you transfer the cost amount, you’re making the job more profitable (or less unprofitable) than it really was. And you’re making the other job -- the one getting the transfer -- less profitable, since it’s showing costs it really didn’t incur.

So it’s more accurate to transfer only the gross amount you want -- and leaving the cost amount zero. Both jobs will show their true cost of production, as well as a more accurate gross margin.

You can transfer the cost amount or gross amount from any job and task. To transfer only the billable amount, unselect the transfer net amts option. You can’t transfer more than a task’s unbilled costs.

Job cost transfers affect jobs only. The General Ledger is unchanged by job cost transfers. Job cost transfers don’t update jobs and tasks until they are posted. Posting removes the cost and/or gross amounts from the original job, then moves them to the new job ticket.

Hours are not moved when a time cost is transferred; only the cost and gross amounts are transferred. Instead, add adjusting time entries to move hours from one job to another.

Job cost transfers can transfer unbilled hours from time cards and time sheets.

For more information, see the Job Cost Transfers FAQ.

Access to transfer job costs

Before you can transfer costs, you need to be allowed access to job cost transfers. This setting appears in the Costs section of the Users, Access, & Passwords setup window. If you do not have access to cost transfers, ask your System Manager to give you access by selecting the Xfers checkbox for your staff file.

To transfer a job cost

1 Choose Accounting > Job Cost Transfers.

2 Click the add button

(or choose Edit > Add Job Cost Transfer).

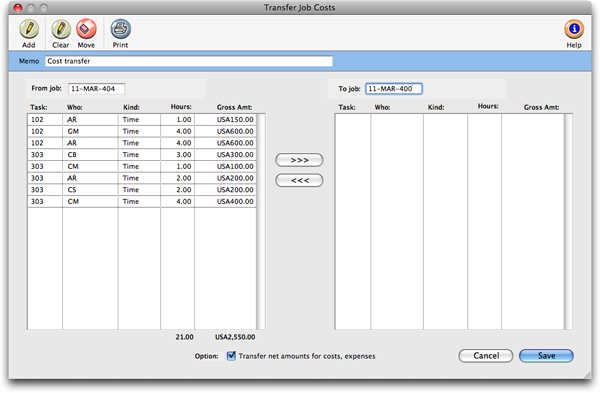

The Transfer Job Costs window opens.

3 Enter the job number from which the costs will be transferred,

then press Tab.

The job’s unbilled costs are listed, sorted by task.

4 Enter the job number to which these costs will be transferred.

This is the job and task that gets the transferred amount.

5 Enter a memo to describe this cost transfer.

This note appears on job cost reports. Make it clear enough so that anyone

can see why this cost was transferred.

6 Click on the arrow buttons to move the costs from

one job to the other. Or select the option Move All to move

all the costs.

At this point a hard-copy printout of this job cost transfer can be printed by choosing File > Print Window.

6 Click Save.

The costs will be moved to the new job and they will reference the same task as on the original job.

To delete a cost transfer

To preserve the job’s audit trail, cost transfers can’t be deleted once they are saved. Job cost transfers can only be deleted by adding a reversing job cost transfer which would move the cost back to its original job.

To print a job cost transfer report

1 Choose Accounting > Job Cost Transfers.

2 Click the print button (or choose File > Print Cost Transfer Reports).

3 Enter a range of dates, then click Print.

Job cost transfers can also be included on job cost reports printed from Snapshots.