Free help: USER GUIDE

Home > Clients & Profits X User Guide > Accounting > Retainer Billing

|

Clients & Profits X Online User Guide |

Client retainers are special-purpose invoices that bill clients, but don't count as income

Retainer billings aren’t considered earned

income, since you haven’t done the work yet. Instead, retainers

are billed as deposits against future billings.

Retainers can only be billed from each client’s retainer schedule.

The retainer schedule contains descriptions and amounts for up to twelve

monthly billings. When you add a retainer invoice, you’ll be prompted

to select a retainer to bill from the client’s schedule. Details

about the billing are copied from the client account to the invoice,

so there’s very little for you to type.

When a retainer is posted, the balance updates the client account --

but only the client’s retainer balance, not the usual account balance.

Retainers update the General Ledger, crediting a liability account (which

you choose) for client deposits/retainers and debiting accounts receivable.

Retainers don’t increase the client’s account balance, so you

won’t confuse regular unpaid invoices from unpaid retainers. Instead,

a special unpaid retainers’ balance tracks them separately.

Retainers can be applied to any unposted job billing. When a retainer

is applied to an invoice, the retainer amount appears as a payment. When

the invoice is posted, your client sees the invoice’s line items

and billing amounts, sales tax, and grand total -- then the balance due,

less the amount applied from retainers.

There are cases where retainers shouldn’t be billed as retainers: If a client pays you a flat monthly fee that isn’t applied to job billings, then it shouldn’t be billed as a retainer. These fees, which usually cover the client’s account service hours, are really earned income because you won’t give the money back if you do no work. Remember, retainers don’t affect your income statement or the client’s balance due. Fee invoices should be added as miscellaneous billings, not retainers.

|

|

|

|

|

Learn

more about retainer billing in this Clients & Profits

classroom video training session, with C&P

Trainer Mindy Williams. Requires Apple Quicktime 7.0 or greater. Running time: 1:06 |

|

|

|

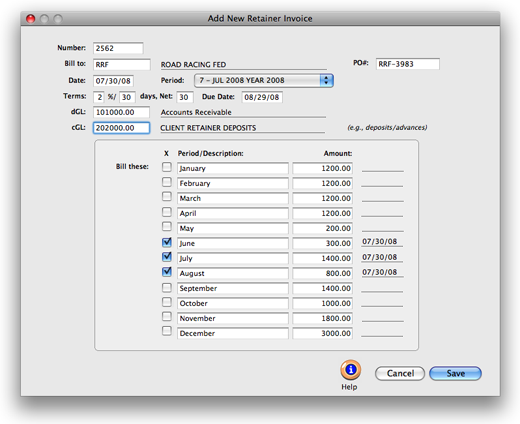

To add a retainer billing

1 From the Accounts Receivable window, choose Edit > Add

New Invoice > Retainer

Billing.

The Add New Retainer Invoice window opens.

2 Enter the invoice number.

3 Enter the invoice’s bill-to client number.

Retainer invoices are billed to one client, and only clients

that have a retainer schedule. When you tab past the client

number, the client’s

scheduled retainer billings are copied to the invoice. Any unbilled retainer

can be billed on a retainer invoice. Previously billed retainers are

disabled, since they have already been billed.

4 Enter the invoice date, accounting period, the client’s

purchase order number, and payment terms.

The invoice date and the accounting period can be different,

for flexibility. This means an invoice can be dated in this

month , but the invoice can be posted to next month’s

financial period.

5 Enter the invoice’s debit and credit G/L accounts.

The retainer’s cGL and dGL are copied from the client’s retainer

schedule, but can be changed. A special A/R account can be created for

tracking retainer receivables, to keep them separate on financial statements.

Likewise, a special “deposits/advances” liability account can

be created to track retainer billings. When a retainer invoice is posted,

it will post debit and credit journal entries to these accounts.

6 Enter the invoice’s due date.

7 Click the bill these checkboxes to add retainer

billings to this invoice.

You can bill one or more monthly retainers on the same invoice,

although usually only one is billed per month. Each monthly

retainer appears as a separate line item, with its own billing

amount, on the printed invoice. The retainer’s description

is copied to the line item and is what the client sees on

the printed invoice. You can change the description as needed;

however, changing the description here changes the retainer

schedule as well. The retainer amount can also be changed, letting you

bill more or less than what was scheduled; changing the amount here changes

the retainer schedule.

8 Click Save.

To see a client’s retainer schedule

1 Choose My > My Clients.

2 Click on the Retainers link.

The Retainer Schedule window shows the client’s retainer history,

including which retainers have been billed so far. The status checkbox

indicates which retainers have been billed, including the date and invoice

number. Billed retainers can’t be changed. Unused retainer is the

amount that can be applied as payments to the client’s upcoming

invoices. Unpaid retainers shows the balance of the client’s unpaid

retainer billings. You can use this amount to track if the client has

paid the retainer invoices (you may not want to apply retainers to new

invoices unless they’ve been paid already).